Mortgage Affordability – 2005 Revisited

About 17 years ago (back in 2005) when mortgage interest rates were around 6% I posted an article called How interest rates can drastically affect real estate prices. At the time I was already amazed by the low interest rates and was concerned they would go up and how it would affect people. It’s finally started to hitting us, and what’s even more challenging is that the percentage increases per 1% is higher than it was in 2005 because interests are so much lower today than back then. In other words going from 6% to 7% is an increase in monthly payment of about 10% whereas going from 3% to 4% is an increase of between 13% and 14%. In fact at the time I hadn’t even calculated below 4% because I never thought it would go that low because that was below the historical inflation rate. We definitely live in different times.

In the last few months we’ve just gone from 3% to about 6%. I’m going to use 30 year fixed interest rate because it’s a lot easier as I can just use the FRED data. In any case that’s a 3% increase in a matter of months. That’s also double the interest rate! Looking at the chart from my previous article about how interest rates affect real estate prices, someone who could afford a $1000/mth mortgage back in the summer of this year could afford up to about $235k mortgage whereas today that translates into a $167k mortgage. That’s a huge drop of about almost 29% affordability. If you look at the median house price across the US of $429k (as of early 2022) then that means a drop of $124k, or a drop from $429k to about $305k. That’s very significant.

That was at the time while the market was hot and people were buying. What happens today when people are struggling financially and buying is much much lower? Where you just can’t flip your house or refinance on a higher valuation? If you look on Reddit there are a lot of stories of people on variable interest rates seeing large increases in their monthly mortgage payments. We’re talking multiple hundreds a month to over a thousand dollars more per month. That hurts.

Let’s do the reverse and let’s calculate the difference in monthly payments on a mortgage that was previously paying $1000/mth at 3% interest. We’re still going to use the 30 year fixed mortgage but the math still applies to variable rate mortgages as well as people who need to refinance. That being said a $1000/mth mortgage at 3% affords you a mortgage amount of about $235k. If we take that same $235k and apply a 6% interest rate then the payments balloon to a little over $1400/mth a month for a 40% increase in your monthly payments.

If we extrapolate that to the median house price (assuming 0% down to make the math easier) then that means a mortgage of $429k with a monthly payment of a little over $1800/mth. Today that has now exploded to $2572/mth for an increase of $772/mth. That’s very significant for the vast majority of people. That’s an increase of almost 43%! It’s not just the percentage but the absolute amount of $772/mth is by itself very significant considering the annual median household in the United States is $70,784 (as of 2021). That’s an increase of over 10% of their salary going to their mortgage. And that’s before taxes! If you do the math after taxes it’s probably 15-20% and higher. Ignoring that the median income generally cannot afford the median house, but if it could then the math would be even more challenging.

And we haven’t even started to touch on the topic of those mortgages which keep the monthly payments the same but add on the difference in payments to the mortgage amount. Meaning that if your monthly payment was suppose to go from $1000/mth to say $1400/mth than that $400/mth difference just gets tacked onto the principal amount. Meaning each month your principal is very likely increasing. For a median house that’s an additional $772/mth increase to the mortgage. It won’t be exactly that because of the details but it’s quite significant nonetheless. In other words they would be getting more and more into debt. What happens when they refinance when the mortgage term is up?

And that’s the key. The fallout will take some time to happen. There’s a lot of complexity and variables but there will be a correction, the question is more of when exactly. The first question is what is the average term of mortgages these days. In other words when are most people due to refinance? Until it comes time to refinance a decent amount of people will be able to muddle through. Not everyone but a lot. But once refinancing hits that’s where it will be very challenging for a lot of people. Especially if interest rates continue to climb as is expected to fight inflation. Yes we’ve pushed back inflation a little bit but I don’t believe that battle is anywhere near over. The other question is how many are on variable rates that can continue to holdout.

In addition as interest rates climb prices of houses have to fall. Prices were so high because affordability was so high because of the historically low interest rates. Aka free money. But in turn when interests go back up that also means house prices will have to drop which in turn means for a lot of people their equity will be decreasing. Instead of refinancing to take out equity of their property they will have to put in balloon payments if they end up being underwater. Can they afford that difference?

The other question is will inflation continue to be higher than interest rates because if it does then that could help out a lot people. So for example if inflation were to be at 10% (an even number) then assuming you had a 10% raise and the interest rate on your mortgage remained at the current 6% then you would actually be ahead. That mortgage would be worth less in 2022 dollars. As a more extreme analogy imagine a $30k mortgage for a house in 1980. $30k today is a much smaller amount then it was in 1980 and would be much more manageable then the median $429k. Of course it won’t be as extreme but when inflation is higher then interest rates it can be challenging. Even more so if salaries rise with inflation, which unfortunately doesn’t seem to be the case right now. Nonetheless inflation is having an impact on mortgage affordability.

Seeing as the goal of the Fed is to keep inflation rates in check I believe they will have no choice but to continue raising interest rates until inflation starts to go down, at least in the short term. At the very least keeping it higher then we’ve been used to for many years until inflation starts to get more reasonable. And that’s relative, even today’s “high” interest rates should be considered historically low interest rates. Pre-2000 interest rates were pretty much always above the current rate of 6%. The real question is how will this all play out in terms of interest rates and inflation as they both have very big impacts on loans and mortgages. The speed and scale at which they are moving doesn’t give the markets the chance to easily absorb the changes. This is leading to a lot of chaos and distress right now.

On a positive note there will be a lot of buying opportunities in the near future for those who position themselves well. Even with all the doom and gloom, or in fact because of the doom and gloom, there will be some great opportunities. As the saying goes, fortunes are made and lost in times of chaos, and we are clearly heading in such a time. Not that 2020-2022 were easy times, I just suspect that 2023 will be more interesting in terms of the impacts interest rates and inflation will have on the markets (financial and real estate). We’re about to see the true costs of all the recent money printing and the long term low interest rates. The can was kicked down the road but we’re now getting near the end of the road and can’t really keep kicking it much further without risking high inflation which is a much bigger and worse problem. Some even speculate a once in a generation market crash, a super cycle if you will. Whatever happens the thing to remember is that when there is chaos there is always good opportunities for both failures and much much more importantly successes. May you be one of the successful stories of 2023!

Permalink to this article Discussions (0)

LandlordMax Cloud Edition Released

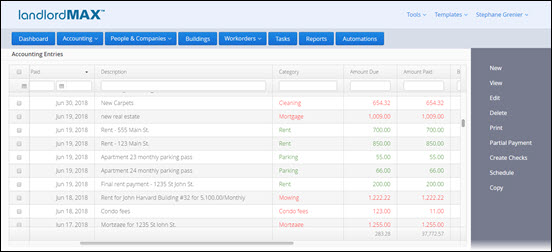

The LandlordMax Cloud Edition is now publicly available! Although we pre-released it a few months ago to existing customers I’m happy and proud to say it’s now publicly available to everyone! You can access the new Cloud Edition at: https://app.LandlordMax.com You’ll find the Cloud Edition also includes some new features that are exclusive to the Cloud Edition including but not limited to:

- Online and web based

- Ability to edit entries in the tables directly

- Searching and filtering on ALL columns in the tables

- Ability to create custom reports

- Many new reports including the completely redesigned Profit & Loss reports

- Very significant performance improvements

- Built-in word processor

- Completely redesigned Automations which can run custom reports

- Multi-user and computer support at no additional costs

- And so on…

You can click here to read the full release notes which includes most of the new exclusive features of the Cloud Edition. The release notes include screenshots and instructions on how the new features work and how to use them, basically everything you need to start using the Cloud Edition.

If you’re already a LandlordMax user and haven’t yet tried the Cloud Edition then please note the free 30 day trial also applies to existing users of the previous Editions of LandlordMax. You can transfer your existing database to the Cloud Edition.

Before I continue I just want to take a moment to say we sent out a lot of emails to notify our existing customers but please note that if your email is no longer current then you would not have received your invitation email. It’s also possible we haven’t yet sent out your pre-release invitation as we were sending them out in phases. Our goal was to send out invitations to at least half of our customers before we released it publicly to give people a chance to transition, the rest of the invitations should be coming in the following months. In any case you can start right away, you don’t need an invitation any more to start using the new LandlordMax Cloud Edition.

With that I’m proud to say we were able to include almost every single feature we wanted to that I listed in my post on this blog here from two years ago which is amazing. Even better we included some features and functionality I said we would not be able to include in the initial release of the Cloud Edition! Specifically we included filters and searching on all tables, customization of printouts, built in word processor, custom reporting, and the ability to edit entries directly in the tables. We also significantly improved the reports, and some got complete overhauls such as the Profit & Loss and Tenant Statement reports. And very importantly we completely redesigned the Automations which now allow you to run any landlord or tenant report in batches, even custom reports you create!

The Cloud Edition is a major new version, I should say Edition, and it includes a lot of new exclusive features. Again I definitely recommend looking at the Release Notes. I initially planned on going through many of the bigger points but I quickly released it got too long and instead decided to refer you the Cloud Edition release notes. As you can well imagine we’re very excited about this release!

If you have any questions please contact our support team. We’d also love to hear your feedback on the new Cloud Edition, so please feel free to send us feedback and comments you may have as well.

And with that I invite you all to the new LandlordMax Cloud Edition!

Permalink to this article Discussions (0)

Top Real Estate Podcasts

As most of you already know I’m the founder of LandlordMax a company which makes property management software. As a result I try to stay up to date with everything real estate related, and part of this effort is listening to real estate podcasts. What I’ve unfortunately found is that often potentially interesting podcasts are short-lived. People often start new podcasts and within a few weeks to a few months it’s basically over. As a result today I decided to make a list, partially for myself, of all the podcasts I’ve listened to at least once that have over 100 podcasts or have been around for at least several years. In other words podcasts are active and should continue to be active for a long time.

As a side note, if I missed anyone please give me a holler and we can look at adding you to the list.

In alphabetical order the top real estate podcasts that meet the above criteria are:

- Agent Caffeine by Kelly Mitchell

- Best Ever Show by Joe Fairless

- Bigger Pockets

- Eye on Real Estate by Dottie Herman

- Just Start Real Estate by Mike Simmons

- Invest Four More by Mark Ferguson

- Let’s Talk Real Estate Investing by Sharon Vornholt

- Modern American Realtor by Corey and Casey Wright

- Real Estate Investing For Cash Flow by Kevin Bupp

- Real Estate Realities by Robert Whitelaw

- Real Estate Rockstars by Pat Hiban

- Real Estate Success Rocks by Patrick Lilly

- Real Estate Uncensored by Greg McDaniel & Matt Johnson

- Rental Income Podcast by Dan Lane

- Super Agents Live by Toby Salgado

- The Real Estate Insider by Don R. Campbell

- The Real Estate Loop by Gavin Welch

- The Real Wealth Show by Kathy Fettke

- The Rental Rookie by Emily and Kirk

- The Science of Flipping by Justin Colby

- Yes Talk by Kevin Ward

Permalink to this article Discussions (0)

Amazing Tip To Increase Your Real Estate Rental Profits in Less Than a Day

Before I begin let me share a story that some of you might have already hear, at least in some variation of another. A woman sends her husband to the store to buy a ham, but she specifically asks him to have the butcher cut it in half. Of course the husband forgets to ask the butcher, so when he gets home his wife is not too happy that she has to cut the ham in half. The husband then proceeds to ask his wife why she cuts it in half, to which she responds that her mother has always done it that way and that was reason enough for her.

Luckily for the husband, his mother-in-law is there visiting for Xmas. So he takes the opportunity to ask her why she always cut the ham in half before cooking it, to which she replies because that’s how her mother also always did it.

Still not happy with this answer the husband convinces his wife to call her grandmother to try and figure out this mystery. After all, this is now three generations that have always cut their hams in half before cooking it, and no one knows why. It baffles him that no one has ever asked why. Well thankfully the grandmother finally had the answer, it was because her oven was too small to cook a ham in one piece, so she had to cut it to make it fit. A simple solution to a simple problem that was no longer true.

The moral of the story of course being that everyone just did the same thing because that’s how it had always been done. No one ever questioned WHY it was done that way, they just went ahead and continued to do the same thing.

And this is at the heart of the incredible tip I’m going to offer you today on how to increase your PROFITS, not your income, but your profits, by a pretty significant amount!

As many of you already know, my company LandlordMax Software sells property management software (also sometimes refered to as rental property software, landlord software, and so on). One questions we get asked often enough is if we offer check printing. Which leads right into the tip on how to significantly increase your profits while at the same time reduce your workload!!

Why do people need check printing? Seriously. Think about? Why? Do you really need to have software that prints out tons of checks each month these days? When is the last time you looked at automating their bill payments? Most property managers and landlords just continue to write and send checks for their bills, but why? Because that’s how they’ve always done it. But is it necessary?

Today many many many bills can be completely automated. If you cover the utilities for your tenants as part of the rental agreement, then each payment to the different utility companies can be automated, avoiding the need to write and send a check to each company. We’re not talking just one check here, possibly quite a lot. Today most utility companies have some kind of method or other to have your bills automatically paid.

If you’re a property management company that sends checks out to the individual property owners, there are a number of other options you can exercise. Most banks and financial institutions have all kinds of ways to send money digitally that will save you time and money (and fees). For example most employers these days no longer pay their employees with checks, most just do direct deposit. I’m not suggesting you take their route with your clients, only that there are options out there. When was the last time you looked?

How much of a difference can it make? What is the cost of writing and sending one check? My personal ballpark figure is about $1-$2 per check. This includes the cost to order the checks themselves, then there’s envelopers, stamps, bank fees, etc. I’m also ignoring any penalties for checks lost in the mail, which if you send a lot of checks, you’ll for sure have had some checks lost in the mail.

Above this I’m also not including all the labor costs. Sure the software can automate some of this, but you still need to load your printer with special checks which you probably had to order at a marked up price to match the specific you’re using. Then there’s the time of putting each check into the right envelope, making sure there’s no mistakes along the way. And don’t forget preparing the envelopers and so on. Printing all those mailing labels, sticking them on. It adds up faster than most people realize.

And I haven’t hit the price of the software. If you have a professional property management software solution then you’re easily looking at the thousand dollar or more range. If you’re using a small business accounting software with check printing, then it’s at least some hundreds. If you’re not using any software, then how long does it take you to manually write all those checks? In either situation there is a cost.

With all that in mind, if you have over 100 tenants (an easy round number) at 5 checks a month per tenant on average (plus one property owner payment), you’re looking at spending anywhere from $500-$2000/month of total expenses on just producing checks! Over a year it can easily get into the five figures! I do strongly recommend you look at your own full costs for writing all those checks, don’t just use my numbers. Do your own calculations.

And don’t forget to include the time costs, I can’t imagine an effort like that takes one person less than a full day to accomplish if it was all done at the same time. Over a year that adds up to 2.5 weeks business weeks of full time effort. Yuck. What a waste of time! I don’t know about you, but I have much better things to do. Especially if this can all be automated.

Now imagine that all it took was a day to automate almost all of this effort. No more need to print and/or send checks. Even if you can just automate your regular bills, and for property managers the need to print checks for your clients, how much money and time would you save? And again, this is PURE PROFIT! You’ve just reduced your costs, and not only has it not reduced the quality of your business, you’ve actually increased it!! All this because you’ve finally looked at WHY it’s always been done that way before!

To answer my question about our software, no we currently don’t offer check printing. We would like to, and do plan to eventually offer it (even after all I’ve said). However it’s not normally something you’ll see in competing solutions anywhere our price range. It’s much like a tenant asking for an in-unit hot tub while only paying an affordable rent. You can definitely get an apartment that offers in-unit hot tubs, but you should expect to pay quite a bit in rent. The same is true for check printing. However when people ask us, the answer isn’t really no, it’s more why do you really need check printing? Wouldn’t your time be better invested in researching what you can automate rather than just continuing to do what you’ve always done. Not only will you save on the price of the software, but you’ll save money each and every month from now on! And as an added bonus, the cherry on the whipped cream, you’ll have more time to grow your business rather than spend it on busywork that offers no real and lasting value.

Permalink to this article Discussions (4)

You Can Only Achieve What YOU Believe You Can Achieve

What’s the furthest you believe you will go in life? Do you believe you will own your own company? Do you believe you will be the boss at your job? Do you believe you will climb Everest? Do you believe you will make $1,000,000? Do you believe you will marry the most amazing person?

Firstly, notice I said believe and not think you can. With that in mind, which of the above questions do you truly believe you will achieve?

Now here’s the kicker, I can pretty much guarantee you that if you don’t believe you will achieve it, then you won’t. It’s not very complicated, it’s really that simple!

In the movie Fired Up!, an Animal House style movie, there’s a scene where the team believes they suck and because of that they do! That’s when the hero chimes in with a pretty colorful and somewhat offbeat speech about the importance of believing that you’re good. Below is the exert with some edits (to keep it cleaner for this blog):

– Sorry, guys, I just suck.

– It’s not just you. We all kind of suck.

– We’re not good at all.

– Hey, stop. Stop talking like that.

– But it’s true.

– We’re just not that good.

– Stop.

– Enough of that. You can go as far as you want.

– What do the Panthers have that you don’t have?

– Skills.

– Athleticism.

– Kickass cheers.

– Laser hair removal.

– Big-a** t******. I’m just saying.

– Confidence. They’re cocky a*******.

– Like Nick, the cockiest a******* on the football field. That’s why he’s good.

– He’s right. I’m awesome.

– Because he believes in himself.

– Also because I’m awesome.

– He knows he’s gonna be good, so he’s good. And he takes chances.

– Not hard due to the fact that I’m awesome.

– Nick. Trying to make a speech here.

– I’m sorry.

– Either bet big or go home.

– If you don’t wanna take any chances, then you shouldn’t even be here.

– I know you wanna be here, because you finish last every single year… but you keep coming back… even if it means taking endless shit… from total dong-knockers like the Panthers.

– All right. Come on, guys. Let’s be cocky a*******s.

– Yeah, you know what, he’s right.

– And I can say that… because I am the best cheerleader here, so you can all suck my d***.

– I was just being a cocky a*******.

– Oh, nice. That’s what I told you. Look, did you see what she was doing there?

– That’s exactly what I want from everybody.

– All right, let’s do this.

– And remember, you’re awesome. Let’s risk it to get the biscuit.

– All right, get cocky, b******.

– Let’s do it. Come on, guys. Ready.

– Hit it!

Although a bit colorful, and not exactly what I meant the idea is still really there. If you don’t believe you will succeed you won’t. And because the team thought they were bad, they always finished last.

As an aside, if you don’t believe in yourself, you’ll never take chances, which means you can never really lead. Part of success is also knowing how to create your own luck.

Let’s look at a more concrete example that you can associate in your life. Let’s say you’re making $50,000/year right now and you believe you can’t make more than $65,000. Will you ever make $75,000? No! Why? Because if you don’t think you can make that much, you’ll never ask for that much. You’ll never try to make that much. You won’t do what it takes to make that much. You may achieve up to $65,000, but you’ll never go above that level because that’s as much as you believe you can make.

The same is true with your dream job, the raise you want, the promotion you want, and so on. If you don’t believe in it, you will never try or get it. The very fact of not trying alone will prevent you from succeeding.

And it’s not just jobs, the same is also true for finding your perfect girlfriend/boyfriend/wife/husband. How many people are just too shy to approach the person they really like? They just sit there and wait, thinking they don’t deserve that person. They never take the chance. How many movies are about someone in love but never having the courage to take that initial leap?

The reality is that you have to believe you will succeed to succeed. When I started LandlordMax, I knew it was going to be a success. It was a fact a fact in my mind. And it is succeeding!

As Jeremy Clarkson from Top Gear so well put it in the Bolivia Special episode (4:48): “If you believe something will happen, it will happen”.

Whichever questions above you answered no to, I can almost guarantee you won’t ever achieve. If you don’t believe you can do it, you won’t. It’s not very complicated, it’s really that simple!

In the movie Fired Up!, an Animal House style movie, there’s a scene where the team believes they suck and as such they do! But then our hero explains, in a pretty colorful and more entertaining method, the importance of believing that you’re good. The following is the exert:

Looking at a more concrete example. Let’s say you’re making $50,000/year right now and you believe you can’t make more than $65,000. Will you ever make $75,000? No! Why? Because if you don’t think you can make that much, you’ll never ask for that much. You’ll never try to make that much. You won’t do what it takes to make that much. You may achieve up to $65,000, but you’ll never reach above that level.

The same is true with your dream job. If you don’t think you deserve or can do it, you will never try for it. The very fact of not trying alone will prevent you from succeeding.

And it’s not just jobs, the same is also true for finding your perfect spouse. How many people are to shy to approach the person they really like? They just sit there and wait, thinking they don’t deserve that person. They never take the chance. How many movies are there about someone trying to fall in love with their dream person but never having the courage to take that initial leap?

The reality is that you have to believe you will succeed to succeed. When I started LandlordMax, I knew it was going to be a success. As a matter of fact, I also didn’t really have a choice. It had to succeed. As Jeremy Clarkson from Top Gear put it in the … episode, if you believe it enough, you can will it to happen!

Jeremy clarkson

Sorry, guys, I just suck.

– It’s not just you. We all kind of suck. – We’re not good at all.

– Hey, stop. Stop talking like that. – But it’s true.

We’re just not that good.

Stop.

Enough of that. You can go as far as you want.

What do the Panthers have that you don’t have?

– Skills. – Athleticism.

– Kickass cheers. – Laser hair removal.

Big-ass titties. I’m just saying.

Confidence. They’re cocky assholes.

Like Nick, the cockiest asshole on the football field. That’s why he’s good.

– He’s right. I’m awesome. – Because he believes in himself.

Also because I’m awesome.

He knows he’s gonna be good, so he’s good. And he takes chances.

Not hard due to the fact that I’m awesome.

– Nick. Trying to make a speech here. – I’m sorry.

Either bet big or go home.

If you don’t wanna take any chances, then you shouldn’t even be here.

I know you wanna be here, because you finish last every single year…

but you keep coming back…

even if it means taking endless shit…

from total dong-knockers like the Panthers.

I wanna cut the blond one.

– What? – What?

– What? – What?

– What? – I’m just saying.

All right. Come on, guys. Let’s be cocky assholes.

Yeah, you know what, he’s right.

And I can say that…

because I am the best cheerleader here, so you can all suck my dick.

I was just being a cocky asshole.

Oh, nice. That’s what I told you. Look, did you see what she was doing there?

That’s exactly what I want from everybody.

All right, let’s do this.

And remember, you’re awesome. Let’s risk it to get the biscuit.

All right, get cocky, bitches.

Let’s do it. Come on, guys. Ready.

Hit it!

Permalink to this article Discussions (1)

As If We Weren't In Enough Trouble Already?

We all know the real estate market is in a mess right now, and most of it is really our fault. Too many people took on mortgages they never should have. But it’s not just the borrowers that are guilty, the lenders need to take their share of the blame. Obviously everyone should know when they’re over-extending ourselves, but in obvious situations many lenders still encouraged people to get mortgages. They often helped them get financing through more creative ways, such as loan/mortgage applications that didn’t require any proof of employment, interest only payments, 105% financing, and so on. I won’t even mention mortgages that required high and consistent capital appreciation just to be sustainable.

As part of this mess, many different sales techniques were used. A very common technique was focusing on how much mortgage you CAN afford per month (not how much you SHOULD afford per month). What this means is that instead of looking at the total purchase price, you focus on the monthly payments. By doing this, especially when interest rates are incredibly low, you end up buying properties that in any normal time is well above what you can afford. Which also means that when interest rates go back up, which they will, you’re in a lot of trouble!

Again, the benefit of this selling technique is that you can take the focus away from the real price and look at what you can spend each month. This gives the seller a lot of leeway in the price (not to mention it helps increase commissions). As an example, adding $2000-$5000 on a $500,000 mortgage amortized over 30 years (at our current historically low interest rates) barely changes the monthly total ($9/month and $22/month respectively)! Even adding $20,000 isn’t that big a deal. At 3.5%, $20,000 barely adds $90/month more. $90/month more on a $2500/month mortgage is not a big difference.

But, getting back to the reason for this post, is that lenders have now come up with a new method of rationalizing why you should purchase overpriced properties, or at least a method that I haven’t personally seen yet. Here’s the exert from Tales From the Real Estate Wars:

“Now’s the time to move up to a larger house and eradicate any loss on your present house! How, you say? Come a little closer and I’ll explain: If you bought a house for $350,000 and it is now worth only $280,000 (20% less), you have only “lost” $70,000 if you sit still and do nothing. But if you buy that really big house in the nicer community that used to be worth $550,000 and is now also 20% lower, the moment you close on that house at $440,000, you’ve gained $40,000 ($110,000-70,000). And hey, that’s before you get the $6,500 tax credit! Plus, have you seen how low the interest rates are?”

It’s really perverse logic, but at the same time I can see how people can fall prey to it. They’re focusing on people’s loss aversion fears which is a very strong emotion!

Do you see the flaw in the logic?

Permalink to this article Discussions (0)

Is it a Good Time to Buy Real Estate?

It depends. Don’t you absolutely hate that answer? But the reality is that it really does depends and any other answer is wrong.

It really does depend on the situation and circumstances. For example, it might be a good time to buy real estate in New York city while simultaneously being a bad time to buy in Los Angeles. And even then, and much more importantly, it might be a good or bad time for you personally to buy real estate (or any other revenue generating asset such as stocks, bonds, etc.)!

Let’s look at a simpler case study than real estate to get a better understanding. Let’s pretend you’re the owner of a movie rental store. Instead of real estate, you buy and rent DVD’s. Is it a good time to buy DVD’s? It depends. Firstly how much do the DVDs cost in terms of how much you can rent them for? In other words, will the DVDs make you money? And how long will it take you to start being profitable from buying and renting DVDs?

Before we go on, remember that although you can buy a DVD for say $40, that’s not necessarily your true cost. You also have to include the cost of employees, rent for your store, marketing, people bringing back the movie late, lost inventory, insurance, accountants, etc. However for the sake of this discussion let’s keep it simple, let’s assume the real cost is double the purchase price.

Taking an example, if our total cost to buy a DVD is $80, and we can rent the movie out at $5/day, then it will take 16 days to start making any profit. Not bad. But wait, it’s not that simple. Is the movie going to be rented 16 days in a row? That’s a probability, and you have to assume no. In real estate, we use a similar concept, the vacancy rate, which signifies the percentage of unoccupied units. For now we’re just going to assume the DVD is fully rented. And since most people rent a DVD one day and return it the next day (sometimes two), we’ll use 32 days as a safer assumption. At 32 days, it’s not looking too bad.

But we’re not done. What about late returns? Right now most video stores allow you to return a movie late (by over a week) with no late fee. This will unfortunately over complicated our example, so let’s just assume we can’t charge late fees. Therefore instead of 32 days, we’ll pad our estimate to 60 days, or 2 months. It’s simple and should be good enough.

Is it a good time to buy now? It still depends! Can you actually rent your DVD’s at $5/day in your local area? Are you in a poorer area where $5/day is considered a luxury? Maybe you can only charge $2/day. Or maybe you live in Beverly Hills and you can charge $20/day because you offer mocha lattes for each of your visitors as they peruse your store. The price you can charge for your revenue generating asset, in this case DVD movies, will greatly affect whether or not it’s a good time to buy. At $2/day, it will take you at least half a year of continued rentals to make any profit. Can you rent the DVD for half a year non-stop? Not likely. Most movies fade out of popularity within months, if not weeks, before other newer movies take their place. Hence at $2/day, it’s probably not a good time for you to buy. However if you can rent the DVD at $20/day, it will take you only 2 weeks to start making a profit instead of 2 months. A much better time to buy. Well maybe.

We still can’t know if it’s a good time to buy. Why? What about the specific asset, or in our case the specific movie. If the movie we’re buying is the latest multi-gazillion blockbuster, then it’s probably looking good. But what if it’s the latest Hollywood straight to DVD flop that absolutely no one wants to see? Probably not. We might never even be able to rent it once! It could be a complete lost of time and money. Again, it depends.

But let’s assume it’s the best movie ever made in all of history, and we can rent it out at $10/days and it will only cost us $50 total to buy. Is it still a good time? Again, it depends. What if all you personally have left in your bank account is $10 (and maybe even that $10 is allocated to other pre-existing payments). Then you can’t afford it.

Can we get a loan for the $50? Maybe, but can we afford the payments? Can we carry the loan? We’re assuming it’s the best of the best movies, but what if it’s not? Poseidon anyone? Ignoring that we might make enough money to cover our loan payments on the principal, what about the interest? Can we get an affordable loan at an interest rate that will give us a comfortable return (I say comfortable return because we all have different thresholds for risk)? In other words, even if it’s the greatest deal, can we afford it. Does our personal financial situation allow us to capitalize on it?

So the next time someone asks you: “is it a good time to buy?”, I hope you’ll say it depends because it really does depend! It depends on the specific situation, circumstances, and the assets you want to buy.

PS: I didn’t include the long tail in this example, that is movies that have been out for years and still continue to get rented often. These are very profitable. And the same is true for real estate properties, stocks, etc. Generally the longer you hold onto them, the more money you’ll make. Instead I tried to focus on whether or not you’d be able to get to that longer tail, that if you can at least start making a profit on the assert within a reasonable amount of time.

Permalink to this article Discussions (1)

More LandlordMax Sales Metrics

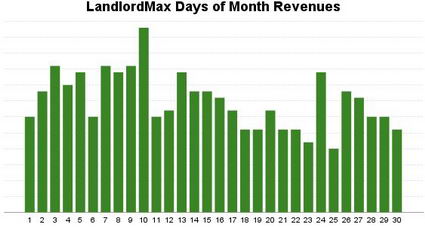

Last week I promised I would post a follow-up article to my previous one about our sales metrics at LandlordMax, where I would show our daily sales averages over a month. Well here’s the graph below:

It’s not exactly what you would expect from a property management software application is it? To quote Eric, the founder of RentARoom.ca, who commented on my previous post (thanks Eric):

“Beginning of the month is probably slow, rising to mid month to it’s peak, and the last days of the month fairly low sales as well. The slowest days: First to Third of the month.

I guess property managers are busy trying to get it all done in their old system. They give up by mid month, or catch their breaths and say they have to find an “easier” way by next month and find a new program.

So by that, advertising just before mid month would be best. (depending on first ad seen -first visit to the website- and conversion to a buying decision)”

That was exactly my initial thoughts. And this proves why it’s so important to get real hard data rather than assuming. In this case common sense is wrong, including mine. The best days for our sales are at the beginning of the month, when landlords and property management companies are at their busiest.

Not only that, but when they’re at their quietest time is when we get the least sales. In other words when we expect the most sales is when we’ll get the least!

Why is the real buying pattern almost the opposite of what we’d expect? Although I don’t know for sure and I can only speculate, my guess is they buy LandlordMax when they’re experiencing their biggest pains. That is they buy it when they need it most rather than when they have the most time. The biggest time for sales is when all the rents are due.

Interesting isn’t it? Common sense in this case proves to be wrong. Getting cold hard data made a real difference, it was very educational. It’s also a very big reminder to always double check your intuition with data. I’m sure glad I did!

Permalink to this article Discussions (4)

Foreclosure's Map

Someone notified me of a map they found on USAToday’s website which merges a map with foreclosures in Denver since 2006. I recommend checking it out. Although the foreclosure data is limited to one of the hardest hit areas of the city, it’s still very interesting!

Permalink to this article Discussions (2)

Ignorance is Bliss

There’s been a lot of panic recently associated to the collapse of Bear Stearn, one of the largest financial institutions in the world. Yes this is dramatic and will have far reaching consequences, but there’s something far scarier than that which pretty much everyone is overlooking. And in this case, this ignorance is what’s preventing the economy from collapsing. Ignorance is bliss!

Yes a major financial institution collapsed. Yes it happened in just a few days. Yes it’s a catastrophe. But there’s something far larger and more ominous looming just beneath the covers. The really really really scary part is that no one wanted to acquire them for pennies on the dollar without the Fed’s adding $30 billion to sweeten the deal!!!

Why is that? I can only come up with two reasons, both of which are incredibly scary.

- Everybody else is on the edge of insolvency and can’t afford a fire sale deal, even for pennies on the dollar.

- The number on the balance sheet are much worse than they appear and hence the revenues are collapsing (mortgages defaults are much much much higher than expected).

All I can say is WOW! Both of these options are incredibly scary and lead me to conclude that the worse hasn’t even yet begun.

[Disclaimer: Please note my numbers in the following analogy aren’t to scale as I haven’t yet had the time to fully absorb the details. ]

To take an analogy on a smaller scale, imagine that you own a house worth $600,000. Everything seems to be going fine, then within two days you somehow can’t meet your obligations. In other words you’ve become insolvent because of a cashflow issue almost instantaneously. Now imagine further that you can’t find any buyers for your house, even at $20,000. Yes the house does come with a mortgage that you have to assume, but it’s also being rented and is earning revenues. Up until a few days ago, you were supposedly maintaining profitability on it.

Which is scarier? The fact that you went insolvent or that there are no buyers when the house is going for a steal? By far the scariest thing is that there are no buyers. But now imagine further that to eventually get a buyer you need to have a third party (the Fed’s) add a large sum of money to make the deal happen. Getting pennies on the dollar wasn’t enough.

Which means either the revenues on the property weren’t exactly as good as you you stated or there is no one else with enough capital to buy a house at a fire sale price. I sincerely hope it’s because the deal wasn’t lucrative enough (the revenues weren’t as good as stated), otherwise the alternative is much worse and you can expect many more insolvency in the near future!

If it’s the later, than ignorance truly is bliss and might even save the economy!

Permalink to this article Discussions (2)

| NEXT PAGE » |