Is There Really a Real Estate Bubble?

Yes! Many of the articles on this website clearly indicate a real estate bubble. Today I came accross an interesting article by the Angry Bear which helps to confirm that there is a real estate bubble. This article is more about the impact of a housing bust on the economy in large, however it does provide some great information, including two very important graphs.

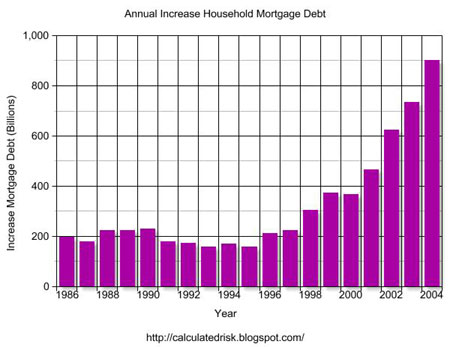

The first graph, seen above, shows a large increase in annual household mortgage debt. This is not a small increase, it’s a very significant increase! The amount was fairly constant for at least a decade until around the mid-90’s, at which time it just exploded, almost at a 45 degree angle. This means that a lot of individuals are getting much more leveraged than before, well beyond the historical averages.

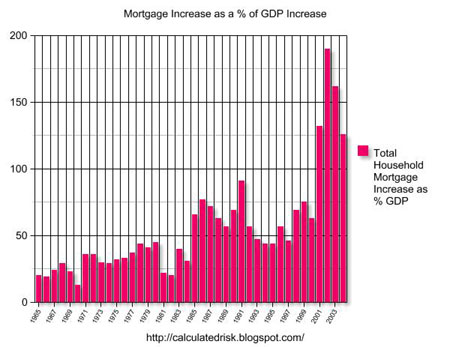

The second graph shows that for the first time in at least 40 years, the annual increase in mortgage debt has been larger than GDP growth in the US. All these, plus the interest rate indicators, definetely lead me to believe a bust is going to happen very soon!

The article also mentions that mortgage equity withdrawal has significantly increased, that is the amount of money borrowed against your home. This is what has in part, along other factors, fueled the refinancing boom. More and more people are taking out the equity from their houses to use elsewhere, often to pay or acquire consumer debt rather than re-investments.

To quote the article on the significance of this graph:

“Hatzius has calculated that homeowners have pulled $640 Billion from their homes in 2004, as compared to just $74 Billion ten years ago.”

That’s about nine times the mortgage equity withdrawal from a decade ago! Combined with the above two graphs, as well as the interest rate article I recently wrote, and the quote from business week, this really tells me that we’re in for a serious real estate bust.!