Free Business Idea

Ideas are a dime a dozen, and today I’m going to give you my latest business idea. It’s easy to say I came up with this idea (I’m probably not the only one) and I could possibly make decent money from it, but the reality is that it won’t go anywhere unless I do something. Again, ideas are a dime a dozen, execution is 99% of the battle. And I can honestly say that in this case there won’t be any execution. Even if it was the best idea I just don’t have the time or resources to execute on it. So if you’re interested in pursuing this idea, please by all means take it and roll with it. It’s all yours!

The Idea:

Today there is a large discrepancy in the price of new car for the same model between Canada and the US. The difference is large enough that people are taking trips to the US with only the intention of buying a new car. Even after taking into consideration the loss of the warranty, the costs of the time, lodging, dinning, export fees, currency exchange, and so on, you can come out quite ahead. For example I recently saw the same new car advertised for $40,000 CDN and $25,000 in the US. When you consider that the CDN dollar is worth more than the US dollar right now, that’s crazy! $15,000 goes a long way to paying repairs in the first 5 years of ownership, more than your warranty will ever cover.

So the business idea is not to buy and sell cars, that’s too complicated and there are already tons of car dealerships doing that. Rather what I’m proposing is a delivery service, much like FedEx. The business is composed solely of picking up a pre-purchased car at a dealership in the US and bringing it to a specific location in Canada for pickup. A simple delivery service. It would include going through customs and paying the appropriate fees, but in essence it’s just a very niche delivery service taking advantage of a limited time price difference.

Again, this is simply a delivery business. Nothing more. You don’t buy the cars, your customers have already done this. At no point do you ever own the car. You’re just picking up a parcel, in this case a new car, and bringing it to another location.

Why would someone pay for this? Well if you charge a reasonable amount it’s worth it. You’re basically saving your customers the hassle of a road trip, the time to wait at the border for customs to process your car, etc. The advantage for you is that if you do this with a car carrier truck you don’t just bring one car at a time, you can deliver a small fleet of cars at once. You get the advantage of economies of scale. Not very large, but large enough to make a pretty good profit margin.

Of course this business opportunity won’t be around forever. Eventually the new car dealerships will have to adjust their prices. That’s just a matter of time. But if you’re willing to make the effort and execute on the idea then I’m pretty confident there’s profits to be made for at least several months. If you charge somewhere between $2,000-$5,000 per car, that should easily cover your expenses and give you a decent profit margin.

Since this is a limited time business opportunity, you also don’t want to grow too big. Therefore I would suggest local advertising, possibly something even as simple as classified ads. If you’re even more ambitious you could definitely get some media attention. I can easily envision seeing this on the nightly news.

So there you have. A free business idea. Will it work? I don’t know for sure but I’m pretty confident there’s profit to be had here. The idea does have a lower barrier to entry, anyone can come up with it and execute on it. The question is how many people will actually do it. Ideas are a dime a dozen!

Permalink to this article Discussions (2)

Is it Possible to Predict When a Market will Crash?

Every once in a while a specific blog comment will elicit a full article rather than a simple blog comment response. Recently Andy Brice from Successful Software (founder of Perfect Table Plan) wrote such a comment on my recent blog entry Manias, Panics, and Crashes: A History of Financial Crisis:

“Interesting. I’m expecting the insane UK housing market to level off or crash any time now. But I’ve been saying that for the last 5 years…”

Andy is a very smart person whose blog I regularly read (and sometimes comment on). Whose opinion I respect. In this case I absolutely agree with him. I’ve been saying the same thing for North America for some time now, as is evident even in my first month of blogging over two years ago here on FollowSteph.com.

The interesting part of his comment is that he (myself included) know just how hard it is to accurately predict a full economic shift from mania to bust. It’s easy enough to see when we’re in a mania; the fundamental economic principles no longer govern asset prices. But what’s hard is to predict when the general public will realize this. It’s just like the Tulip Bulb boom of long ago; as long as there’s a bigger “sucker” willing to pay more for the asset (in that case rare tulip bulbs) the prices are going to keep increasing.

But now comes the reality. Again it’s not possible to exactly predict when a boom or bust will actually happen, it’s easy to predict when we’re in a boom or bust phase. If the economic fundamental no longer justify the prices then we’re in for either a bust (overly priced as is today) or a boom (under priced as often happens when people overcompensate after a depression). The bigger the discrepancy the bigger the boom or bust.

The good news is that although we can’t accurately predict the exact time a bust will happen, we can still accurately predict when it’s a good time to get in and out at a profit. As Benjamin Graham expresses in his book The Intelligent Investor, as long as you’re buying your asset for less than the real value (intrinsic value) and selling it at a higher price than the real value you’re ahead. He doesn’t show you how to maximize your profit, he just helps you identify how much your asset is overpriced or under priced. No one can accurately tell you when an asset has reached its maximum price (over valuation), that’s speculating on you knowing and understanding the publics psyche which no one can do.

To put it in other words, asset (stocks, real estate, etc.) prices will always shift above and below their true economic value (known as intrinsic value). If you buy them for less than their intrinsic value you’re ahead. If you sell them for more than their intrinsic value you’re ahead. The key to investing is not to try to buy assets at their lowest price and then sell them at their highest price, no one can do this. It would be amazing if that were possible, but it’s not.

What does this all lead to? Well over time an asset can only deviate so much above or below its intrinsic (real) value before it has to re-align itself (adjust its price back to a reasonable value). Right now, at least in North America for sure, prices of real estate properties have deviated significantly above their intrinsic value, so much so that they are now correcting themselves and trying to re-adjust to their intrinsic value. And don’t think we’re there yet, they’ve still got a lot of re-adjusting to do. I expect significantly more fallout before it stabilizes. As a very basic general rule of thumb, a real estate investment property should generate you at least a yearly revenue of 10% of the purchase price (including all costs – renovations, closing costs, etc.). Right now we’re not even close to this, many properties are running at negative cash flow values! This isn’t sustainable.

Knowing this however doesn’t mean you can’t profit from the boom and bust cycles. All it means is that if you buy assets in the under priced area of the above graph and sell in the overpriced areas you should be able to consistently make profits and protect yourself. The “margin of safety” is generally considered to be the discrepancy between the actual price and the intrinsic value – that is how much the asset is under priced. The further off you from the intrinsic value you are, the bigger the profit potential and the closer you are to the max and min’s of the boom and bust cycles. Of course you need to be extremely careful the further away you are from the intrinsic value, especially for overpriced assets, because when the adjustment happens it will be faster and more volatile!

It’s possible to consistently achieve respectable profits, all you need to do is look at the intrinsic value to know when to get in and out. Although sometimes it may take years for an assets actual price to at least come back to it’s intrinsic value, it eventually does. But as Andy’s comment suggests, knowing when a market has peaked is hard to predict. He already knew that the intrinsic value was no longer aligned with the actual price of the asset (in this case real estate), but he still couldn’t know when the adjustment would occur. No one can!

Permalink to this article Discussions (8)

Manias, Panics, and Crashes: A History of Financial Crisis

Are we doomed to repeat history? Unfortunately yes! The book Manias, Panics, and Crashes: A History of Financial Crisis originally written in 1978, now on it’s fifth edition (2005), clearly illustrates just how predictable we are:

“The end of a period of rising prices for assets to distress whenever a significant number of investors have based their purchases of these assets on the anticipation that their prices will continue to increase. Some of these investors may have a ‘negative carry’ in that the interest rates on the funds borrowed to buy the assets exceed the cash income on the assets; these investors anticipated that they would be able to use the increase in value of the asset as collateral for new loans that would proved them with some of the cash that they would need to pay the interest on the outstanding loans. When asset prices stop increasing, these investors are shunted into distress mode since they have no ready way to get the cash they need to pay the interest on their outstanding indebtedness.”

And what about:

“Causes of distress and the symptoms of distress are observed at the same time and include sharply rising interest rates in some or all segments of the capital market, an increase in the interest rates paid by sub-prime borrowers relative to the interest rates paid by prime borrowers, a sharp depreciation of the currency in the foreign exchange market, an increase in bankruptcies, and an end of the price increases in commodities, securities, and real estate. These developments are often related and show that the lenders have become over-extended and are trying to reduce their exposure to risks and especially to large risks.”

Sound familiar to anyone? And to think this was written years ago and it’s repeating itself yet another time. History does repeat itself.

The good news is that if you educate yourself you can come out ahead. And this is why I strongly recommend the book Manias, Panics, and Crashes: A History of Financial Crisis. It’s a pretty intense book written using somewhat verbose and specific economic terms, as you’ve probably already noticed from the quotes above. Therefore if you’re not familiar with economics and business expect it to take a bit longer. But overall the information is excellent and very viable. And although I believe myself to be fairly well versed in economics and business, this book sure brought home some points I hadn’t fully appreciated. A very good read. Well worth your time.

Permalink to this article Discussions (4)

US Dollar = Canadian Dollar

Although I thought it wouldn’t happen until at least the end of this month, the USD is now equal to the CDN. In reality it’s actually now worth a little bit less. although temporarily negligible I suspect it will significantly widen before it settles down.

As I look at it this very moment: $1.00 USD = $0.9984 CDN

As a Canadian I should be rooting for a stronger CDN dollar to increase my purchasing power, but as the founder and majority owner of LandlordMax I’m rooting for a stronger USD because 86% of our sales are to the US and hence in USD.

Permalink to this article Discussions (2)

Why There's Still Credit Card Fraud

Every wonder why there’s still so much credit card fraud? About 2-3 weeks ago I saw a really documentary on Dateline about online credit fraud, well mostly about identity theft, but still very relevant. It’s what triggered this article. In any case the commentator did a great presentation, and showed how many people get taken. He was even able to show how within a day or so they set up a fake online store to accept stolen credit cards orders on the internet. They did it in a day!

So why is this still happening? Why are stolen credit cards continually used to purchase products when we know how it’s done. Why aren’t credit card companies stopping it cold, or at least bringing it way down?

The answer lies with their motivation and incentives. A while ago I wrote a glowing recommendation on a book entitled “Freakonomics“, where one of the things the book really showed you is that you need to pay close attention to motivations and incentives. And once I started to ponder about the credit card companies motivations, things became a lot clearer. The incentives and motivations just aren’t there to completely remove credit card fraud. There are of course strong motivations to keep it low, but not to completely eliminate it.

Why?

Before going into detail, let’s take a look at an example of what happens to us at LandlordMax when someone uses a stolen credit card to purchase our property management software (although it very rarely happens, no one is completely immune to it). Firstly, the fraudster goes online and makes a purchase of LandlordMax. The credit card company authorizes the transaction saying the credit card is valid and has the sufficient funds. Once we get this ok, we then proceed to finalize the transaction and send the customer their product. Everything is looking good and all parties are happy. However within the next few days, more often weeks to months, we receive a notice from the credit company that the transaction they authorized was fraudulent (more often than not it’s because of a stolen credit card). However here’s where it gets interesting, it doesn’t end there, the credit card company then takes back the funds they authorized (remember they told us it was ok to proceed).

So let’s look at the motivations. Firstly they aren’t liable for lost funds. Yes they authorized it, but they aren’t liable, the merchant is. If the card is stolen, the credit card company doesn’t lose a penny, the merchant takes all the risks and losses. Not only does the merchants lose their funds, but you also have to remember that their out of product as well. So for example, if you sold a diamond ring for $2000, not only would you have to give back the $2000 but odds are the diamond ring is nowhere to be found.

Understanding this, it quickly becomes very clear why they aren’t motivated towards a zero tolerance on stolen credit cards. It basically becomes a cost to benefit equation, they have to cleverly balance how much theft they can let go by without people losing confidence in them. To put it in other words, it costs money to detect fraudulent transactions and to be on top of criminals, exponentially more expensive as you get closer to a zero tolerance. What they have to figure out is how much theft is acceptable so that people will still have confidence in their product (and continue to use credit cards) while not paying too much to prevent this fraud. It’s a very fine line to balance. As they get ever closer to zero tolerance their costs go up with diminishing returns.

Remember the key ingredient here is that they aren’t liable for losses they authorized, the merchant is. So their only real motivation is to instill confidence in their customers (credit card holders) that using their credit cards is safe (where they get a percentage of every transaction). They don’t really have a motivation to produce a 100% safe credit card system, at least not until they’re on the hook for the losses instead of the merchants.

Without pushing the point further, don’t get me started about chargebacks. Another one of my favorite pet peeves with credit card companies. If someone ever decides to do a chargeback, of which we’ve had a grand total of 2-3 over the last 4 years which is an incredibly low percentage, not only do the credit card companies take the money back but they also charge you a significant chargeback fee! If you look at their motivation, it’s definitely towards the credit card holders and not the merchants. They have no vested interest in helping you, they don’t lose a cent, they actually make money if chargebacks go through.

So if you take a good look at what motivates credit card companies in terms of protecting people against credit card fraud, its probably not what you expected. Yes they are motivated to keep credit card fraud down, but they are definitely not motivated to completely stop it. It just doesn’t make economic sense for them. Ethically it’s a different story, but unfortunately today the economics is the reality.

Permalink to this article Discussions (15)

Why a Balanced Portfolio Can Be Bad For You

I strongly believe a balanced portfolio, and especially the act of continually re-balancing it, is bad for you! Why? For three main reasons:

1. You shouldn’t have to force yourself to invest an exact percentage of your net worth in specific investment assets just to match your asset allocation percentages (for example you shouldn’t have to invest 50% of your money in stocks just because that’s what you allocated to it, there might not be that many deals out there worth it).

2. Each time you re-allocate you’re penalized with broker commissions and capital appreciation taxes

3. The most important point, each time you re-balance your portfolio, you’re losing money by moving money from your best performing assets to your worst performing assets. I’ve never ever seen this as a good way of making money!

Before I explain these three points in detail, let’s first look at why the modern balanced portfolio was created. Balanced portfolios were built with the intention of reducing market volatility. To quote, “The underlying logic behind the hybrids is simple: when stocks are hot, the funds will be able to tap the trend. When stocks are shaky, investors will probably seek shelter in bonds. That’s when the bond portfolio of a balanced or asset allocation fund will steady things.”

I don’t deny this one bit, a balanced portfolio will generate a much smoother growth curve for you with reduced volatility, there’s no doubt about. You’ll see this in the examples I use to illustrate my point below. You could even create a real concrete sample with the exact values of the last 20 years and show very similar numbers. I would have done this except that I didn’t have the real numbers handy when I created these charts. If you have them, please feel free to post a link in the comments below and I’ll add a further example as time permits. In any case, the reality is that yes, it will reduce your market volatility. However, the longer you stay in the market and the more astute an investor you are, the less this is an issue.

Ok, we talked about reducing market volatility, but what about getting the best return? The balanced portfolio was not created to get the best return, it was created simply to reduce the volatility. It does this at the expense of a better return! I’m not willing to trade this, especially not after working the numbers. The difference is just not worth it…

Alright, now that we understand why this investment style was created, let’s look at why it’s not good. Let’s start with the easiest and simplest reason why not. How do you know what a correct balanced portfolio of your assets is? Is 50% in stock and 50% in bonds a good asset allocation? What about 25/75, 75/25, 10/90? What about a portion in options, commodities, etc. How do you really know what a good allocation is? What’s actually interesting is that depending on how you do this allocation, it will greatly affect how much return your going to receive versus how much volatility you’ll also receive. The more conversative the lower the return and volatility.

| Year | Bond | Stocks | Total | Return | Rebalance Bond | Rebalance Stock | New Total | Total Return |

|---|---|---|---|---|---|---|---|---|

| Start | 1,000.00 | 1,000.00 | 2,000.00 | 1,000.00 | 1,000.00 | 2,000.00 | ||

| 1 | 1,040.00 | 1,120.00 | 2,160.00 | 8.00% | 1,080.00 | 1,080.00 | 2,160.00 | 8.00% |

| 2 | 1,081.60 | 1,254.40 | 2,336.00 | 8.15% | 1,166.40 | 1,166.40 | 2,332.80 | 8.00% |

| 3 | 1,124.86 | 1,404.93 | 2,529.79 | 8.30% | 1,259.71 | 1,259.71 | 2,519.42 | 8.00% |

| 4 | 1,169.86 | 1,573.52 | 2,743.38 | 8.44% | 1,360.49 | 1,360.49 | 2,720.98 | 8.00% |

| 5 | 1,216.65 | 1,762.34 | 2,978.99 | 8.59% | 1,469.33 | 1,469.33 | 2,938.66 | 8.00% |

| 6 | 1,265.32 | 1,973.82 | 3,239.14 | 8.73% | 1,586.87 | 1,586.87 | 3,173.75 | 8.00% |

| 7 | 1,315.93 | 2,210.68 | 3,526.61 | 8.87% | 1,713.82 | 1,713.82 | 3,427.65 | 8.00% |

| 8 | 1,368.57 | 2,475.96 | 3,844.53 | 9.01% | 1,850.93 | 1,850.93 | 3,701.86 | 8.00% |

| 9 | 1,423.31 | 2,773.08 | 4,196.39 | 9.15% | 1,999.00 | 1,999.00 | 3,998.01 | 8.00% |

| 10 | 1,480.24 | 3,105.85 | 4,586.09 | 9.29% | 2,158.92 | 2,158.92 | 4,317.85 | 8.00% |

| 11 | 1,539.45 | 3,478.55 | 5,018.00 | 9.42% | 2,331.64 | 2,331.64 | 4,663.28 | 8.00% |

| 12 | 1,601.03 | 3,895.98 | 5,497.01 | 9.55% | 2,518.17 | 2,518.17 | 5,036.34 | 8.00% |

| 13 | 1,665.07 | 4,363.49 | 6,028.57 | 9.67% | 2,719.62 | 2,719.62 | 5,439.25 | 8.00% |

| 14 | 1,731.68 | 4,887.11 | 6,618.79 | 9.79% | 2,937.19 | 2,937.19 | 5,874.39 | 8.00% |

| 15 | 1,800.94 | 5,473.57 | 7,274.51 | 9.91% | 3,172.17 | 3,172.17 | 6,344.34 | 8.00% |

| 16 | 1,872.98 | 6,130.39 | 8,003.37 | 10.02% | 3,425.94 | 3,425.94 | 6,851.89 | 8.00% |

| 17 | 1,947.90 | 6,866.04 | 8,813.94 | 10.13% | 3,700.02 | 3,700.02 | 7,400.04 | 8.00% |

| 18 | 2,025.82 | 7,689.97 | 9,715.78 | 10.23% | 3,996.02 | 3,996.02 | 7,992.04 | 8.00% |

| 19 | 2,106.85 | 8,612.76 | 10,719.61 | 10.33% | 4,315.70 | 4,315.70 | 8,631.40 | 8.00% |

| 20 | 2,191.12 | 9,646.29 | 11,837.42 | 10.43% | 4,660.96 | 4,660.96 | 9,321.91 | 8.00% |

| Year | Bond | Stocks | Total | Return | Rebalance Bond | Rebalance Stock | New Total | Total Return |

|---|---|---|---|---|---|---|---|---|

| Start | 500.00 | 1,500.00 | 2,000.00 | 500.00 | 1,500.00 | 2,000.00 | ||

| 1 | 520.00 | 1,680.00 | 2,200.00 | 10.00% | 550.00 | 1,650.00 | 2,200.00 | 9.09% |

| 2 | 540.80 | 1,881.60 | 2,422.40 | 10.11% | 605.00 | 1,815.00 | 2,420.00 | 9.09% |

| 3 | 562.43 | 2,107.39 | 2,669.82 | 10.21% | 665.50 | 1,996.50 | 2,662.00 | 9.09% |

| 4 | 584.93 | 2,360.28 | 2,945.21 | 10.31% | 732.05 | 2,196.15 | 2,928.20 | 9.09% |

| 5 | 608.33 | 2,643.51 | 3,251.84 | 10.41% | 805.26 | 2,415.77 | 3,221.02 | 9.09% |

| 6 | 632.66 | 2,960.73 | 3,593.39 | 10.50% | 885.78 | 2,657.34 | 3,543.12 | 9.09% |

| 7 | 657.97 | 3,316.02 | 3,973.99 | 10.59% | 974.36 | 2,923.08 | 3,897.43 | 9.09% |

| 8 | 684.28 | 3,713.94 | 4,398.23 | 10.68% | 1,071.79 | 3,215.38 | 4,287.18 | 9.09% |

| 9 | 711.66 | 4,159.62 | 4,871.27 | 10.76% | 1,178.97 | 3,536.92 | 4,715.90 | 9.09% |

| 10 | 740.12 | 4,658.77 | 5,398.89 | 10.83% | 1,296.87 | 3,890.61 | 5,187.48 | 9.09% |

| 11 | 769.73 | 5,217.82 | 5,987.55 | 10.90% | 1,426.56 | 4,279.68 | 5,706.23 | 9.09% |

| 12 | 800.52 | 5,843.96 | 6,644.48 | 10.97% | 1,569.21 | 4,707.64 | 6,276.86 | 9.09% |

| 13 | 832.54 | 6,545.24 | 7,377.78 | 11.04% | 1,726.14 | 5,178.41 | 6,904.54 | 9.09% |

| 14 | 865.84 | 7,330.67 | 8,196.51 | 11.10% | 1,898.75 | 5,696.25 | 7,595.00 | 9.09% |

| 15 | 900.47 | 8,210.35 | 9,110.82 | 11.15% | 2,088.62 | 6,265.87 | 8,354.50 | 9.09% |

| 16 | 936.49 | 9,195.59 | 10,132.08 | 11.21% | 2,297.49 | 6,892.46 | 9,189.95 | 9.09% |

| 17 | 973.95 | 10,299.06 | 11,273.01 | 11.26% | 2,527.24 | 7,581.71 | 10,108.94 | 9.09% |

| 18 | 1,012.91 | 11,534.95 | 12,547.86 | 11.31% | 2,779.96 | 8,339.88 | 11,119.83 | 9.09% |

| 19 | 1,053.42 | 12,919.14 | 13,972.57 | 11.35% | 3,057.95 | 9,173.86 | 12,231.82 | 9.09% |

| 20 | 1,095.56 | 14,469.44 | 15,565.00 | 11.40% | 3,363.75 | 10,091.25 | 13,455.00 | 9.09% |

| Year | Bond | Stocks | Total | Return | Rebalance Bond | Rebalance Stock | New Total | Total Return |

|---|---|---|---|---|---|---|---|---|

| Start | 1,500.00 | 500.00 | 2,000.00 | 1,500.00 | 500.00 | 2,000.00 | ||

| 1 | 1,560.00 | 560.00 | 2,120.00 | 6.00% | 1,590.00 | 530.00 | 2,120.00 | 6.00% |

| 2 | 1,622.40 | 627.20 | 2,249.60 | 6.11% | 1,685.40 | 561.80 | 2,247.20 | 6.00% |

| 3 | 1,687.30 | 702.46 | 2,389.76 | 6.23% | 1,786.52 | 595.51 | 2,382.03 | 6.00% |

| 4 | 1,754.79 | 786.76 | 2,541.55 | 6.35% | 1,893.72 | 631.24 | 2,524.95 | 6.00% |

| 5 | 1,824.98 | 881.17 | 2,706.15 | 6.48% | 2,007.34 | 669.11 | 2,676.45 | 6.00% |

| 6 | 1,897.98 | 986.91 | 2,884.89 | 6.60% | 2,127.78 | 709.26 | 2,837.04 | 6.00% |

| 7 | 1,973.90 | 1,105.34 | 3,079.24 | 6.74% | 2,255.45 | 751.82 | 3,007.26 | 6.00% |

| 8 | 2,052.85 | 1,237.98 | 3,290.84 | 6.87% | 2,390.77 | 796.92 | 3,187.70 | 6.00% |

| 9 | 2,134.97 | 1,386.54 | 3,521.51 | 7.01% | 2,534.22 | 844.74 | 3,378.96 | 6.00% |

| 10 | 2,220.37 | 1,552.92 | 3,773.29 | 7.15% | 2,686.27 | 895.42 | 3,581.70 | 6.00% |

| 11 | 2,309.18 | 1,739.27 | 4,048.46 | 7.29% | 2,847.45 | 949.15 | 3,796.60 | 6.00% |

| 12 | 2,401.55 | 1,947.99 | 4,349.54 | 7.44% | 3,018.29 | 1,006.10 | 4,024.39 | 6.00% |

| 13 | 2,497.61 | 2,181.75 | 4,679.36 | 7.58% | 3,199.39 | 1,066.46 | 4,265.86 | 6.00% |

| 14 | 2,597.51 | 2,443.56 | 5,041.07 | 7.73% | 3,391.36 | 1,130.45 | 4,521.81 | 6.00% |

| 15 | 2,701.42 | 2,736.78 | 5,438.20 | 7.88% | 3,594.84 | 1,198.28 | 4,793.12 | 6.00% |

| 16 | 2,809.47 | 3,065.20 | 5,874.67 | 8.03% | 3,810.53 | 1,270.18 | 5,080.70 | 6.00% |

| 17 | 2,921.85 | 3,433.02 | 6,354.87 | 8.17% | 4,039.16 | 1,346.39 | 5,385.55 | 6.00% |

| 18 | 3,038.72 | 3,844.98 | 6,883.71 | 8.32% | 4,281.51 | 1,427.17 | 5,708.68 | 6.00% |

| 19 | 3,160.27 | 4,306.38 | 7,466.65 | 8.47% | 4,538.40 | 1,512.80 | 6,051.20 | 6.00% |

| 20 | 3,286.68 | 4,823.15 | 8,109.83 | 8.61% | 4,810.70 | 1,603.57 | 6,414.27 | 6.00% |

Assuming we do know what a good balanced asset allocation is, how do we know we can actually find any good deals in those classes, never mind great deals? How do we know we can again find the same percentages of good deal each and every year when we need to rebalance our portfolio? Sometimes stocks are overpriced, other times bonds are a bad investment… The same can be said for all investment classes and vehicles. Maybe it’s sector based, maybe industry, maybe equity based, etc. How can you know that you will find good deals year over year in each of your asset classes for the percentages you need? If you look at Warren Buffett, who doesn’t really limit himself in terms of investment classes other than those he can understand, he has often been found to say that there are no good investments at this time. Therefore he would rather hold cash with a very low return than buy assets that are underperforming, he’d rather wait for that great deal because the return on investment is worth it many times over! Here you would be forcing your hand because you decided that x% of your assets should be allocated in this type of investment versus that type, whether it’s a good deal or not.

So far we know that we don’t really know how to split up our investment appropriately and that it’s highly unlikely we’ll find good deals each year in all our asset classes (stocks, bonds, etc.) for the rebalancings that we enforce upon ourselves. But what about the extra commission costs each year to re-allocate our assets? If I buy a stock that’s performing well for 5-10 years, as long as I don’t sell it, I don’t pay any commissions or taxes! With an value based portfolio I assume a minimum holding period of 3-10 years (Buffett suggests an infinite holding period) which I myself generally do (the only time I sold my stocks was to cash out to start my company LandlordMax). Going back to commissions, yes, this is a small amount but it does add up if you do it each and every year over multiple trades. Let’s assume a 1% commission rate, that means that each year you lose 1%. Compound that over time and it quickly adds up. 1% over 20 years compounded on a compounded amount is a lot.

What hits you harder though is capital appreciation taxes when rebalancing each year. Since I’ve already written about the drastic affects capital appreciation taxes can have, I’ll only write a small quick example and let you refer to my prior article for the details. Assuming you bought $10,000 shares of company xyz with a 12% rate of return, after year 1 you’d have $11,200. Depending on how many you need to sell to balance your portfolio, you’ll need to pay taxes on those gains. Assuming you need to sell $1000 to rebalance your portfolio with a 36% tax rate, you’ll lose $360 of your gains. That’s $360 that can’t be compounded each year just because your portfolio didn’t match your exact percentages! And remember this number will drastically increase as the size of your portfolio does.

Alright, now that we know the simple reasons, let’s look at the last and most important reason of why. Each time you rebalance your portfolio, you’re in essence trading some of your best performing assets for some more of your worst performing assets. To put it in another way, you’re selling your best performing asset to buy more of your worse performing asset. If I ever heard of a bad way to make money, this would be it! In business you generally try to shed away your worse business units. In real estate you generally try to sell your low cashflow (or cashflow negative) properties. In a balanced portfolio you’re trying to get rid of some of your best performing investments to invest more money into your worst performing ones. That makes no sense to me!!!

I know that for some of you this might not be intuitive, so let’s look at the details, let’s crunch some numbers. Now before I begin, I’ll just let you know that all these numbers have some assumptions for simplicity. All the example below assume a portfolio of two assets, stocks and bonds. They assume a 4% rate of return on bonds (near today’s rate) and a 12% rate of return for stocks. The timeline is also assumed to be 20 years, except for the final example which is for 50 years.

So what I did to crunch the number is try 3 different ways to balance a portfolio of stocks and bonds. I worked out 75%/25%, 50%/50%, and 25%/75% splits. In every single scenario the balanced portfolio made less money. Please note also that none of the scenarios took into consideration the extra losses due to commissions and especially to capital appreciation taxes, as we mentioned above. Therefore in reality the discrepency would be even larger!

Anyways, looking at the numbers, what I found is that if you start a portfolio with a specific balance and let it play out, over time it will increase it’s rate of return to that of the best performing asset. This makes perfect sense because that asset will take up a larger and larger percentage of your total portfolio. To give an example, if you start with a 25% stock and 75% bond allocation, over time the stocks will become a larger and larger percentage of your total portfolio (for those of you who are mathematicians, if you do a limit to infinity eventually the stocks will approach 100% of the portfolio as they’ll completely dwarf the bonds in size). Using our above assumptions, after 15 years stocks become more than 50% of the portfolio ($2,736.78 versus $2,701.42 for bonds). After 50 years, assuming a starting balance of $500 in stocks and $1500 in bonds, the difference is a 14 to 1 ratio! The balance becomes $144,501.09 in stocks and $10,660.03 for bonds. A very large discrepency!

| Year | Bond | Stocks | Total | Return | Rebalance Bond | Rebalance Stock | New Total | Total Return |

|---|---|---|---|---|---|---|---|---|

| Start | 1,500.00 | 500.00 | 2,000.00 | 1,500.00 | 500.00 | 2,000.00 | ||

| 1 | 1,560.00 | 560.00 | 2,120.00 | 6.00% | 1,590.00 | 530.00 | 2,120.00 | 6.00% |

| 2 | 1,622.40 | 627.20 | 2,249.60 | 6.11% | 1,685.40 | 561.80 | 2,247.20 | 6.00% |

| 3 | 1,687.30 | 702.46 | 2,389.76 | 6.23% | 1,786.52 | 595.51 | 2,382.03 | 6.00% |

| 4 | 1,754.79 | 786.76 | 2,541.55 | 6.35% | 1,893.72 | 631.24 | 2,524.95 | 6.00% |

| 5 | 1,824.98 | 881.17 | 2,706.15 | 6.48% | 2,007.34 | 669.11 | 2,676.45 | 6.00% |

| 6 | 1,897.98 | 986.91 | 2,884.89 | 6.60% | 2,127.78 | 709.26 | 2,837.04 | 6.00% |

| 7 | 1,973.90 | 1,105.34 | 3,079.24 | 6.74% | 2,255.45 | 751.82 | 3,007.26 | 6.00% |

| 8 | 2,052.85 | 1,237.98 | 3,290.84 | 6.87% | 2,390.77 | 796.92 | 3,187.70 | 6.00% |

| 9 | 2,134.97 | 1,386.54 | 3,521.51 | 7.01% | 2,534.22 | 844.74 | 3,378.96 | 6.00% |

| 10 | 2,220.37 | 1,552.92 | 3,773.29 | 7.15% | 2,686.27 | 895.42 | 3,581.70 | 6.00% |

| 11 | 2,309.18 | 1,739.27 | 4,048.46 | 7.29% | 2,847.45 | 949.15 | 3,796.60 | 6.00% |

| 12 | 2,401.55 | 1,947.99 | 4,349.54 | 7.44% | 3,018.29 | 1,006.10 | 4,024.39 | 6.00% |

| 13 | 2,497.61 | 2,181.75 | 4,679.36 | 7.58% | 3,199.39 | 1,066.46 | 4,265.86 | 6.00% |

| 14 | 2,597.51 | 2,443.56 | 5,041.07 | 7.73% | 3,391.36 | 1,130.45 | 4,521.81 | 6.00% |

| 15 | 2,701.42 | 2,736.78 | 5,438.20 | 7.88% | 3,594.84 | 1,198.28 | 4,793.12 | 6.00% |

| 16 | 2,809.47 | 3,065.20 | 5,874.67 | 8.03% | 3,810.53 | 1,270.18 | 5,080.70 | 6.00% |

| 17 | 2,921.85 | 3,433.02 | 6,354.87 | 8.17% | 4,039.16 | 1,346.39 | 5,385.55 | 6.00% |

| 18 | 3,038.72 | 3,844.98 | 6,883.71 | 8.32% | 4,281.51 | 1,427.17 | 5,708.68 | 6.00% |

| 19 | 3,160.27 | 4,306.38 | 7,466.65 | 8.47% | 4,538.40 | 1,512.80 | 6,051.20 | 6.00% |

| 20 | 3,286.68 | 4,823.15 | 8,109.83 | 8.61% | 4,810.70 | 1,603.57 | 6,414.27 | 6.00% |

| 21 | 3,418.15 | 5,401.92 | 8,820.08 | 8.76% | 5,099.35 | 1,699.78 | 6,799.13 | 6.00% |

| 22 | 3,554.88 | 6,050.16 | 9,605.03 | 8.90% | 5,405.31 | 1,801.77 | 7,207.07 | 6.00% |

| 23 | 3,697.07 | 6,776.17 | 10,473.25 | 9.04% | 5,729.62 | 1,909.87 | 7,639.50 | 6.00% |

| 24 | 3,844.96 | 7,589.31 | 11,434.27 | 9.18% | 6,073.40 | 2,024.47 | 8,097.87 | 6.00% |

| 25 | 3,998.75 | 8,500.03 | 12,498.79 | 9.31% | 6,437.81 | 2,145.94 | 8,583.74 | 6.00% |

| 26 | 4,158.70 | 9,520.04 | 13,678.74 | 9.44% | 6,824.07 | 2,274.69 | 9,098.77 | 6.00% |

| 27 | 4,325.05 | 10,662.44 | 14,987.49 | 9.57% | 7,233.52 | 2,411.17 | 9,644.69 | 6.00% |

| 28 | 4,498.05 | 11,941.93 | 16,439.99 | 9.69% | 7,667.53 | 2,555.84 | 10,223.37 | 6.00% |

| 29 | 4,677.98 | 13,374.97 | 18,052.94 | 9.81% | 8,127.58 | 2,709.19 | 10,836.78 | 6.00% |

| 30 | 4,865.10 | 14,979.96 | 19,845.06 | 9.93% | 8,615.24 | 2,871.75 | 11,486.98 | 6.00% |

| 31 | 5,059.70 | 16,777.56 | 21,837.26 | 10.04% | 9,132.15 | 3,044.05 | 12,176.20 | 6.00% |

| 32 | 5,262.09 | 18,790.86 | 24,052.95 | 10.15% | 9,680.08 | 3,226.69 | 12,906.77 | 6.00% |

| 33 | 5,472.57 | 21,045.77 | 26,518.34 | 10.25% | 10,260.88 | 3,420.29 | 13,681.18 | 6.00% |

| 34 | 5,691.47 | 23,571.26 | 29,262.73 | 10.35% | 10,876.54 | 3,625.51 | 14,502.05 | 6.00% |

| 35 | 5,919.13 | 26,399.81 | 32,318.94 | 10.44% | 11,529.13 | 3,843.04 | 15,372.17 | 6.00% |

| 36 | 6,155.90 | 29,567.79 | 35,723.69 | 10.53% | 12,220.88 | 4,073.63 | 16,294.50 | 6.00% |

| 37 | 6,402.13 | 33,115.92 | 39,518.06 | 10.62% | 12,954.13 | 4,318.04 | 17,272.17 | 6.00% |

| 38 | 6,658.22 | 37,089.83 | 43,748.05 | 10.70% | 13,731.38 | 4,577.13 | 18,308.50 | 6.00% |

| 39 | 6,924.55 | 41,540.61 | 48,465.16 | 10.78% | 14,555.26 | 4,851.75 | 19,407.01 | 6.00% |

| 40 | 7,201.53 | 46,525.49 | 53,727.02 | 10.86% | 15,428.58 | 5,142.86 | 20,571.44 | 6.00% |

| 41 | 7,489.59 | 52,108.54 | 59,598.14 | 10.93% | 16,354.29 | 5,451.43 | 21,805.72 | 6.00% |

| 42 | 7,789.18 | 58,361.57 | 66,150.74 | 10.99% | 17,335.55 | 5,778.52 | 23,114.07 | 6.00% |

| 43 | 8,100.74 | 65,364.96 | 73,465.70 | 11.06% | 18,375.68 | 6,125.23 | 24,500.91 | 6.00% |

| 44 | 8,424.77 | 73,208.75 | 81,633.52 | 11.12% | 19,478.22 | 6,492.74 | 25,970.96 | 6.00% |

| 45 | 8,761.76 | 81,993.80 | 90,755.57 | 11.17% | 20,646.92 | 6,882.31 | 27,529.22 | 6.00% |

| 46 | 9,112.23 | 91,833.06 | 100,945.29 | 11.23% | 21,885.73 | 7,295.24 | 29,180.97 | 6.00% |

| 47 | 9,476.72 | 102,853.03 | 112,329.75 | 11.28% | 23,198.88 | 7,732.96 | 30,931.83 | 6.00% |

| 48 | 9,855.79 | 115,195.39 | 125,051.18 | 11.33% | 24,590.81 | 8,196.94 | 32,787.74 | 6.00% |

| 49 | 10,250.02 | 129,018.83 | 139,268.86 | 11.37% | 26,066.26 | 8,688.75 | 34,755.01 | 6.00% |

| 50 | 10,660.03 | 144,501.09 | 155,161.12 | 11.41% | 27,630.23 | 9,210.08 | 36,840.31 | 6.00% |

As you saw in the examples above, in each and every case the balanced portfolio falls behind the unbalanced portfolio. The numbers don’t lie! I challenge you to try to find a balanced portfolio that will beat an unbalanced portfolio over 20 years (assuming an even allocation of assets at the beginning, so for example if you use stocks and bonds only, the portfolio would start with 50% stocks and 50% bonds). Of course I’ll want to see the numbers and the details, but if you do I will post a full entry about it giving you full credit, it won’t just be post in the comments! I’m so sure of this that I’ll even offer a free copy of LandlordMax Property Management Software to the first person who can find an example where a balanced portfolio will beat an unbalanced portfolio over 20 years!

Before I finish, let me leave you with a few additional thoughts. A balanced portfolio assumes that you’re qualified to find deals in all your different asset classes (stocks, bonds, etc.). I personally don’t believe anyone can find deals in all asset classes, it’s just too much information for any one person to know. I also personally believe that you should only invest in what you know and understand well, no matter what the investment class it is. By having a balanced portfolio, you’re forcing yourself to invest in asset classes that might not be right for you or that you have limited knowledge in.

Another quick note about the balanced portfolio investment style is that it assumes the market is efficient. The reality is that this is simply not true! Markets are not efficient, there are emotions and speculation. Anyone want to explain the dot com boom and bust in terms of an efficient market? I think not! The reality is that the market is not efficient because there are always deals to be had. Just like in the real estate market, there are always good and bad opportunities.

In any case, to finish up as I could point out several other issues I have with the balanced portfolio investment style, I think you can already see why it’s not an optimal investment strategy. The whole reason it was invented was not to be optimal but rather to reduce volatily! Don’t ever forget that! Only use this investment method if that’s your goal, don’t use it for any other reason.

Permalink to this article Discussions (2)

Ideas are a Dime a Dozen

I don’t know if I’ve posted about this before, but it keeps coming up over and over again with people I talk who want to start a businesses, invest in real estate, start new projects, etc. Either they don’t have a new novel idea to start with, or if they do, they think the idea is worth a mint. The reality is that both of these preconceptions are dead wrong! Ideas are worth very little, it’s the execution that’s worth it’s weight in gold!

Let’s think about this a little… How many times have you heard someone say something like “I thought of that years ago. I should be a millionaire”. I know I’ve heard it a lot. The reality is that 99.99% of the general population doesn’t follow through with their ideas, at least not much past the first few months. Most people aren’t willing to put in the effort it takes to get an idea off the ground. And make no mistake about it, it takes effort. By the way, health gyms are notorious for using this to their advantage. They get you to buy a year membership, with an initiation fee, knowing full well that the majority of their members will stop using the facilities within a few months. Are you one of these people?

I can also tell you that I come up with potentially successful business ideas every day. The problem is that I can’t try them all out. You need to focus on one idea and push through it because it will take time for it to come to fruition. If you decide to invest in real estate, than expect it to take you many properties and deals before you can retire, you won’t retire on one golden deal (also you probably won’t have the experience to know what a golden deal is without some experience). In business the same is true, it takes time for a business to gain momentum and get off the ground. Don’t keep moving from project to project, which is easy to do as soon as you hit a speed bump or when you think of something new and exciting. If you study psychology at all (or probably through common sense), you’ll know that people like novelty more than repetition, so it’s very easy to get sidetracked.

On the other side of the coin, you have those who think they need to come up with a golden idea to make it. They think that everything’s done and there’s nothing they can do. Guess again, there’s lots of things everyone can do, you just need to put your mind to it. And please don’t ask me what you can do, that’s what you have to come up with yourself. Make that your first goal! Come up with an idea. Now don’t think it has to be original, it doesn’t. Just look at what’s happening in your area of interest, see what others are doing, look at who’s succeeding, and see if there’s more room in the market for you. How many grocery chains are there, movie rental chains, real estate investors, software companies, chocolate bar producers, tv shows, etc. You don’t need to be original, you just need to look at it from a slightly different angle. Maybe a higher quality, cheaper price, best locally, fastest, better service, etc.

The next major obstacle I often hear is that I don’t have enough money to get going. The reality is that if you think too big to start, than absolutely you don’t have the money. You might need to start smaller and grow from there. If you’re a real estate investor, start with a single resident home instead of with an apartment complex. Maybe one in a more affordable community. If it’s a business, look at something that can be started with your current capital. It can be as simple as a web service, a blog, a software application. You could even sell cookies, a lot of large companies have started this way.

Who’s familiar with the purple dinosaur Barney? How many of you know it was started by a mother (Sheryl Leach) in 1987 as home videos she wrote and filmed herself because she was dissatisfied with the selection of home videos on the market to amuse her own son? She produced three “Barney and the Backyard Gang” videos and marketed then to day-care centers and video stores until they were finally discovered by a PBS director in 1991. And the rest, to quote a cliche, is history.

So what are the steps to success?

1. Get started! That means now! We all have things happening in our lives, it’s just a matter of priorities. If you can find the time to watch any TV, then you can find the time to get started. I can tell you right now that for me it’s 11:15pm right now (actually I’m now revising this entry, minus some LandlordMax related sidetracks, and it’s 12:35am now) and I’ll be up on the computer for at least another hour or two working (as I’ve just confirmed). I live by the principle of work extremely hard for 5 or so years and then completely relax for the rest of my life rather than work moderatly for my whole life. So get started, find the time, it’s there.

2. It’s a marathon, not a sprint. That is, stay the course. Yes, you’re all pumped and the first 2-3 weeks go flying by. You get some work done but suddenly its your friends wedding on the weekend. One weekend isn’t so bad. But the next thing you know you have a party you just have to attend, a supper, a celebration, a birthday. And then there’s the bbq the weekend afterwards at your parents. And not to mention the fact that it’s SuperBowl weekend right after and everyone meets up for that. Suddenly a month goes by and nothing gets done, so you stop working. The project pitters to a dead stop. This is exactly how health gyms make their money! Stay the course. Push yourself. Set your priorities. Know what’s important to you and live accordingly.

3. Educate yourself. This means spend time AND money on educating yourself. I think I’ve read every book there is on real estate, business, marketing, sales, software development, etc. I try to read one book a week that’s related to what I’m trying to do. Yes I still read the odd novel, but again, base your priorities on what you want. A novel to me is like going to the movies, so I read them when I need a break. Not all my books are interesting, actually I can tell you many are really pretty boring and hard to read, but the content is worth the effort. Try to read a lot of what will help you succeed. The unfortunate side is that it’s not always the most interesting material.

Also attend seminars, talk to people in your industry, join like minded groups. For example, I belong to several local groups, the latest of which was just formed. This last one is a group focused on generating passive income here in Ottawa that meets once a month to discuss any and all passive income opportunities available out there (stocks, real estate, automated businesses, web sites, etc.) Take the time to educate yourself, you’re worth it.

4. Spend on yourself. Most people think that they can start a business, invest in real estate, and so on, with just time. It’s possible, but don’t be afraid to invest money on yourself. I can’t tell you how many people get flustered when I start to share my expenses in regards to LandlordMax and FollowSteph. They’re all pumped to get started, but as soon as I suggest they look at investing $500-$1000 on themselves and their idea, WAIT A MINUTE!!! “I don’t know, that’s seems like an aweful lot of money.” Well let me put it another way, if you don’t even believe in yourself and your idea enough to put down a little money on it, do you think anyone else will? Why are so many people afraid to invest in themselves? I don’t understand it. Don’t they realize that their employers are doing just that, they expect to make more money from their labour and skills than they pay them (that’s how business works)? I can’t imagine a world in which I wouldn’t be willing to invest in myself and my ideas. I do it all the time. Actually, I’ve been known to be a little trigger happy in this regard. I’m willing to take the chance sooner than later as I’m a big fan of trying rather than theorizing. After all you can’t debate with results, right or wrong (and I’ve proven myself both right and wrong many times).

5. Stay focused. I can’t even count any more how many people have asked me to co-venture with them… From small to larger projects. In the past I would generally hear everyone out, consider their ideas, and possibly be interested, in the least I’d offer some guidance. Today I have a different perspective. After having gone through it so many times, I now tell people that if they have an idea they’d like me to consider as a co-venture, come talk to me again about it in 6-12 months, whether or not they’re succeeding. Why 6-12 months? Simply because I want to see if they’re going to stick with their projects. Again, it all comes down to the fact that the vast majority of people, good intentions or not, will for some reason or another, start to lose interest in their projects within a few months. All I’m trying to do is weed these people out. So far I only know of a very small select few people who’ve gone beyond this! I don’t care whether their succeeding after this time, everyone has different areas of expertise and maybe its something simple their missing, maybe it’s not the great idea it seemed, maybe its an amazing success I missed an opportunity on, it doesn’t matter. I’m personally not interested in any co-ventures unless the person has put in at least 6-12 months of effort, to show me that they’re going to stay the course, that they’re focused, that they’re not just another health gym statistic.

6. Stick to your idea, test it. Lastly, don’t run away as soon as you hit a road block. Get past it. Go around it. Go in a slightly different direction. But keep moving. I can’t tell you how many people hit a road block and stop. If I did that with LandlordMax, well I wouldn’t be here. It’s now been over 3 years now, 4 if you count the year in which I created the initial version. If you think there weren’t some brutal road blocks, think again! To use one of my favorite quotes from I can’t remember who: “It took me 10 years to become an overnight success!“.

And with that, let me just say, you can’t make a journey around the world without first taking a step, so take it! Henry Ford put it another way: “You can’t build a reputation on what you are going to do.” Or as a fellow business owner and investor of mine, Glenn Scott put it: “I would rather see a stupid do’er than a brillant dreamer“.

Permalink to this article Discussions (17)

Top 10 Stock Investing Books Of All-Time

| 1. |  |

The Intelligent Investor: The Definitive Book On Value Investing, Revised Edition: Hands down the first book you should ever read if you’re planning to invest in stocks! |

| 2. |  |

Security Analysis: The Classic 1940 Edition: The most detailed book that I’ve ever read that explains how to invest in stocks. It goes over the financials, how to read SEC filings, how to analyze a company. Everything is in detail, therefore this is not a light reading, but what you get out of it is worth it’s weight (it’s a heavy book). |

| 3. |  |

The Essays of Warren Buffett : Lessons for Corporate America: There’s nothing like reading directly from the richest person ever who made his fortune by investing in stocks! This is a collection of many of his best pieces, grouped together into topics. |

| 4. |  |

The Warren Buffett Way, Second Edition: A very good introduction on what to look for in stocks. Almost like a follow-up to The Intelligent Investor mentioned above as the #1 stock investing book. |

| 5. |  |

How to Lie With Statistics: If you’re going to invest in stocks, you need to be able to read graphs, there’s no doubt about it. The key however is that you need to understand how to properly read graphs because it’s very easy to manipulate their meaning by simple modifications (with the exact same data)! |

| 6. |  |

A Random Walk Down Wall Street: Anyone who’s educated themselves in stocks knows there are many investing philosphies and styles. This book goes through many of the more common ones and tries to determine which is better. In case you’re curious, the author believes that throwing a dart to pick your stocks gives you just as good of odds over the long term as any investment strategy. I don’t believe this, but he makes a very compelling case. |

| 7. |  |

Take On the Street: What Wall Street and Corporate America Don’t Want You to Know: I recommend this book not for its overall content, but for the great take aways on how the mutual fund market works. I was never fond of the mutual fund market, and now I know for sure that I’ll never invest in mutual funds. |

| 8. |  |

Reminiscences of a Stock Operator: This is the disguised story of the stock speculator Jesse Livermore from long ago who used shady practices to make and lose a lot of money. What’s good about this book is that it’s got an interesting perspective on when to buy, sell, or hold a position in any investment vehicle. |

| 9. |  |

Buffett : The Making of an American Capitalist: The best way to be successful at anything it to learn from the best, and Warren Buffett has consistently shown himself to be the most profitable stock investor in the world. Therefore no list would be complete without his biography, and this is the best one I’ve read about him. |

| 10. |  |

When Genius Failed : The Rise and Fall of Long-Term Capital Management: This is the real story of a group of individuals that over leveraged themselves on their investments and almost collapsed the market. I recommend this book not because of it’s entirety, but because there are some great nuggets of wisdom spread throughout. |

Permalink to this article Discussions (11)

How to Generate Traffic for Your Website

I’ve been asked to be one of 3 keynote speakers/instructors in a 4-day intensive training class on how to generate passive income online. The course will be held here locally in Ottawa over 2 weekends (the weekends of August 12-13 and 19-20). Spacing is very limited, it’s already 50% sold out and it was only annouced yesterday! Anyone interested should contact Glenn Scott before the August 4th deadline to register. The cost of attending is $250/person, which is phenomally low considering that you get 3 speakers for substantially less than it would cost you to just have one of them speak individually!. This is a one-time opportunity, this course will only be offered this one time.

As an extra, this course will be recorded for resale later on DVD. I’ve already made arrangements with Glenn Scott to be able to resell the DVD here through FollowSteph.com, so if you’re not able to come, you can always purchase a DVD copy here when it becomes available. The price of the DVD has not yet been determined.

The course will cover 4 major topics:

Web design

This will by taught by Michael VanDusen who is the head of web design at Algonquin College here in Ottawa. He will use Dreamweaver MX as a tool for building websites which includes lab time (individual computers will be available during the lab time).

Google Adsense Revenue

Glenn Scott will teach how to generate passive income using Google Adsense on your websites. Although he has several streams of income (real estate properties, etc.), Google Adsense is what has allowed him to become financially free at the level he wants.

SEO (Search Engine Optimization)

Glenn Scott wil also cover SEO principles which is very important in getting your site recognized and highly ranked by all the major search engines.

Traffic Generation (my section)

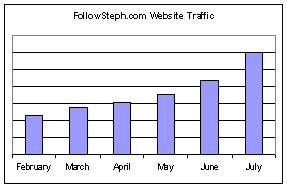

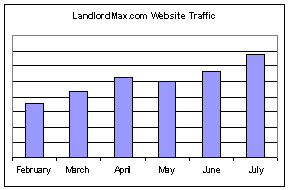

I will personally show you how to generate traffic to your website, be it for monetization, for a small business, etc. I will cover many topics such as blogging, how to get links to your website (link baiting), how to create valuable content, concepts online social networks, copywriting, Google Adwords, press releases, and so on. Basically I’ll show you many ways I’ve learned to make LandlordMax Property Management Software and FollowSteph.com grow in traffic to where they are today (they’ve both at least doubled in the last 6 months alone as shown in the graphs below).

To give you a little history, the concept for this course was actually born from a dinner I attended that was hosted by Glenn Scott entitled “How I Got Out of the Rat Race”. During this dinner many people were interested in learning more details on how he managed to become financially free and suggested he offer a course. And thus 4 weeks later this course was officially offered for this one and only time.

I’m very excited about this project! Not only will I be speaking/instructing one component of the course, but I will be donating my personal time for the other 3 course days to help Glenn and the other speakers/instructors with their components. I will field questions, help with lab times, etc. as I’m also very familiar with these topics. It’s a great opportunity to take advantage of several experts under one umbrella.

I look forward to seeing several of you there!

Permalink to this article Discussions (6)

LandlordMax Free Online Real Estate Analyzer Continues To Double Traffic!

Just a quick update because I promised I would post an update tp the entrepreneurs following this blog, the traffic (measured in unique visitors) to LandlordMax continues to maintain at least double it’s previous best day before the we launched the new LandlordMax Free Online Real Estate Analyzer. Therefore this service continues to be a success as a traffic and buzz generating campaign!

Once at least a month has passed by I’ll write a detailed entry showing some of our results so that you too can benefit from it. But I’ll quickly mention that there is definitely something to be said about offering something of value to generate traffic and buzz!

Permalink to this article Discussions (1)

| « PREVIOUS PAGE | NEXT PAGE » |